Formic Technologies Raises $26.5 Million Series A Led By Lux Capital

The new investments will help Formic accelerate deployments of Robotics-as-a-Service for U.S. manufacturers

CHICAGO—January 18, 2022—Formic Technologies, a provider of turnkey robotic solutions to American manufacturers, has raised $26.5 million in a Series A financing led by Lux Capital with participation from Initialized Capital, Correlation Ventures, Lorimer Ventures, One Planet VC and other strategic investors. In addition, Formic has secured access to more than $100 million of debt capital to fund equipment purchases. This financing will enable the company, now valued at more than $100 million, to expand its operations and support the rapid deployment of its Robots-as-a-Service offering for U.S. manufacturers.

"Formic's model of on-demand robotics is right-sizing automation for customers across all areas of manufacturing," said Shahin Farshchi, partner at Lux Capital. "With the current challenges of the labor market and supply chain, the adaptability that Formic brings to the table is addressing a user area that longtime integrators haven't."

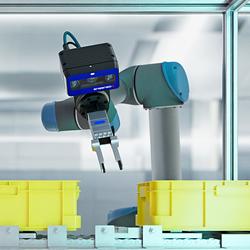

Formic allows American manufacturers to compete globally by giving them access to on-demand automation without upfront investments. Formic delivers full-functioning robotic solutions, consisting of technologies from leading robotic vendors such as Universal Robots, FANUC, KUKA and ABB to customers who pay by the hour for usage. Formic reduces the complexity and cost of automation by owning, programming, installing and maintaining the robots at its own cost. Formic's model is unique in that customers do not pay until the system is deployed and fully operational.

"We're excited to continue partnering with Formic as they change the face of manufacturing," said Garry Tan, managing partner at Initialized Capital. "Robots-as-a-Service is accelerating the robotic revolution by years and lets US manufacturers buy outcomes instead of having to take tech, integration, and financing risk themselves. We know these are some of the most high risk:reward ratios that exist in the world with high IRR's. Formic makes it a no-brainer for thousands of factories and manufacturers."

Formic's RaaS Offers Customized Robotics at "Fraction of the Cost or Effort"

American manufacturers have struggled during the pandemic with chronic labor shortages, supply chain issues, and global price competition. By automating with Formic, manufacturers have started increasing their production and the utilization of their facilities and assets, enabling them to offer better prices and increase profits as a result.

"We came to the conclusion that what manufacturers needed was not any specific new technology, but a better way to access the technology that would best meet their needs," said Saman Farid, co-founder and CEO of Formic Technologies. "Formic offers that access at a fraction of the cost or energy, as we take on the heavy lifting."

According to Farid, an engineer and robotics technology investor who founded Formic with former Universal Robots salesperson Misa Ikhechi, a unique combination of products and services make Formic's model possible:

• Systematized deployment and maintenance processes

• In-house equipment financing

• Formic-designed solutions featuring products from leading robotic partners

Company Expands Executive Team

Concurrent with the financing, Formic has expanded its board of directors and management team with leaders experienced in scaling high-growth businesses. Lux Capital's Farshchi joined Saman on Formic's board of directors. Steve Olszewski, former general manager of FinanceIt, CEO of Spruce Finance and senior vice president of Discover Bank, joined the Formic management team as VP of deployment operations, working closely with Misa Ilkhechi, VP of Sales, and Jack Wagler, treasurer and VP of Finance.

Before founding Formic, Saman was a founding partner of Baidu Ventures, a $600 million technology venture capital fund. He also founded Comet Labs, an early-stage AI and robotics incubator and investment fund. Across his investment career, Saman has invested and sat on the boards of more than 30 AI and robotics companies. Saman was trained as an engineer, and built and sold two companies before becoming an investor.

Formic Technologies is headquartered in Chicago, Illinois, close to many of its first customers in America's manufacturing heartland. These customers include Polar Manufacturing, a 105-year-old maker of custom door and truck body hardware for industrial applications, and Georgia Nut, a 75-year-old manufacturer of confections and nuts. Both chose as their partner to automate with robotics for the very first time in company history.

About Lux Capital

Lux Capital is a venture firm based in New York City and Silicon Valley with more than $4 Bn under management, investing in counter-conventional, seed and early-stage science and technology ventures. Lux was an early investor in iconic companies such as Desktop Metal, Auris Surgical, Evolv, Kurion, Matterport, Nervana, Planet, Zoox, Aeva and more. For more information please visit www.luxcapital.com or follow us on Twitter @Lux_Capital.

About Initialized Capital

Initialized is an early-stage venture firm that invests with conviction before it's obvious. We're a diverse group of founders, builders, and operators who understand how hard it is to build a company. We back visionaries using software to make civilization better and support them through product-market fit and beyond. We're early believers in companies like Coinbase, Instacart, Flexport, and Cruise. Initialized's portfolio—which spans over six core funds —is worth more than $100B in market value; 20+ companies are valued at $1B or more.

About Formic

Founded in September of 2020, Formic is a one-stop-shop for automation. The Chicago-based "Robotics-as-a-Service" company delivers customized robots at a low hourly rate with no money upfront and guaranteed uptime. Its full service includes everything from planning, deployment, to maintenance, all in an easy, no-risk fashion. For more information, visit http://www.formic.co.

Featured Product