IDTechEx Research: Sidewalk Last Mile Delivery Robots: A Billion-Dollar-Market by 2030?

Last mile delivery is the most expensive part of the delivery chain, often representing more than 50% of the overall cost. This is mainly because it is the least productive and automated step. As such, many are seeking to bring automation into the last mile.

In recent years, many companies around the world have been innovating to utilize autonomous mobile robots, drones, and autonomous vehicle technology. In this article, we focus on ground-based autonomous robots.

This report "Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020-2040" covers the use of mobile robots, drones, and autonomous vehicles in delivery, warehousing, and logistics. It provides a comprehensive analysis of all the key players, technologies, and markets.

It covers automated as well as autonomous carts and robots, automated goods-to-person robots, autonomous and collaborative robots, delivery robots, mobile picking robots, autonomous material handling vehicles such as tuggers and forklifts, autonomous trucks, vans, and last mile delivery robots and drones.

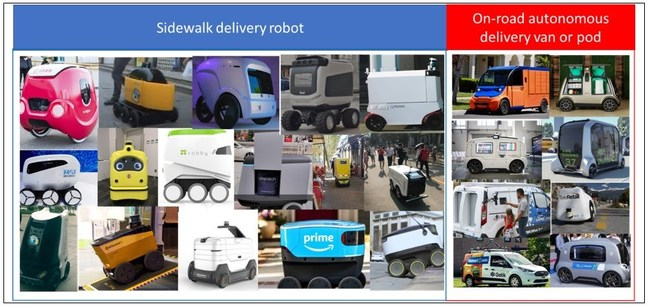

The image below shows various autonomous robots and vehicles (sometimes called pods) developed around the world. These come in a variety of shapes and forms, reflecting the diversity and breadth of design and technology choices which must be made to create such products.

Sidewalk delivery robots vs autonomous delivery vans

These robots, pods, and vehicles are mainly designed from the scratch to be unmanned. They are also almost always battery-powered and electrically-driven. This is for various reasons, including: (1) electronic drive gives better control of motion especially when each wheel can be independently controlled; (2) the interface between the electronic control system and the electrical drive train is simpler, eliminating the need for complex by-wire systems found in autonomous ICE vehicles; and (3) their production process needs to handle vastly fewer parts, and as such could be taken on by smaller manufacturers.

Another key technology and business choice is where to navigate. Many robots are designed to travel on sidewalks and pedestrian pavements, while the van-looking pods and vehicles are often designed to be road-going. This choice of where to travel has determining consequences for the design, technology choice, target markets, and business model. In this article, we focus on sidewalk ground robots, leaving the discussion of road-going pods to a follow-on article.

The sidewalk robots are an interesting proposition. They are often designed to travel slowly at 4-6 km/hr. This is to increase safety, to give robots more thinking time, to give remote teleoperators the chance to intervene, and to enable categorizing the robot as a personal device (vs. a vehicle), thus easing legislative challenges.

These robots also come with various hardware choices. For example, some are few-wheeled while many are six-wheeled. Some include a single small-payload compartment, whilst others carry larger multi-item storage compartments. The key choice however is in what perception sensors to use.

Navigation technology choices

Almost all have HD cameras around the robot to give teleoperators the ability to intervene (more on this later). All also have IMUs and GPS and most have ultrasound sensors for near-field sensing. The main choice is whether to use lidar-only, stereo-vision-only, or hybrid.

Lidar can give excellent 360 degree ranging information. The spatial resolution is also very high, beating even the emerging 4D imaging radar. The point cloud is also fairly dense (depending on the lidar choice), enabling good signal processing. Indeed, in recent years, there have been excellent progress in creating labeled training data and deep learning techniques based on lidar data. Lidars however have two major drawbacks: (a) they are expensive and (b) they can have near-field (a few cm) blindspot.

The first is critical. The current high cost of lidar puts the business model at risk. This is because for the business model to succeed the cost of the robots needs be very low, regardless of whether the model is to offer RaaS delivery service or to sell robot units with some maintenance and support. Therefore, the choice to use lidars will represent a bet for the cost of lidar technology to dramatically fall.

Most robots deploying lidars use 16-channel RoboSense or Velodyne lidars. These are mechanical rotating lidars, giving surround viewing. The technology of lidars is evolving with the likes of MEMS or OPA emerging. These could enable cost reduction, but will reduce FoV (field of view), thus mandating the use of more lidar units per robot. We project that the cost of lidars is to significantly fall over the coming years. This has the potential to put such robots on the path towards business viability. The other challenge is near-field blindspots. This is not an issue with cars, but can be in a sidewalk, where many low-lying objects can reside closely to the robot. To resolve these, complementary sensors will be needed.

The other approach is to go lidar-free, using stereo camera as the main perception-for-navigation sensor. This will require the development of camera-based algorithms for localization, object detection, classification, semantic segmentation, and path planning.

No off-the-shelf software solution exists. Indeed, no labeled training dataset exists that would allow training lidar-based, camera-based or hybrid deep neutral networks (DNNs) for sidewalk navigation. The sidewalk environment is vastly different to that of the on-road vehicles. As such, companies will need to collect, calibrate, and meticulously label their own datasets. Furthermore, the datasets will require great diversity to accommodate different light, perception, and local conditions. As such, deployments in many sites even as pilot programs is essential in further improving the robots and can indeed represent a competitive advantage.

The robots are energy constrained. As such, the number of on-board processors and GPUs should be kept to a minimum, and heavy-duty computational tasks such as 3D map-making and edge-extraction should be carried off-line in powerful services. This almost always happens when robots are deployed to a new environment: they are walked around to capture data, the data is sent to servers for processing so it can be converted into a suitable map, earmarking edges, many classes of fixed objects, drivable paths, and so on.

These sidewalk robots are still far from being totally autonomous. First, they are often deployed in environments such as US university campuses where there is little sidewalk traffic and where the sidewalks are well-structured. Many robots are also restricted to daylight and perception-free conditions.

Critically, the suppliers also have remote teleoperator centres. These remote human operators take over, via the internet, when the robots encounter situations they cannot handle with high confidence. Furthermore, they still operate the road-crossings. This step is very dangerous, and the robots are still not able to always perform this independently. The ratio of operators to robots will need to be kept to an absolute minimum if such businesses, which essentially propose to eliminate wage overheads, are to become viable and sustainable.

Long road to profitability lies ahead

In general, there is still much work to do to improve the navigation technology. The robots will need to learn to operate in more complex and varied environments with minimal intervention. This requires extensive investment in software development. This ranges from gathering data, defining object classes, labeling the data, and training the DNNs in many environments and conditions. It also requires writing algorithms for the many challenges the robots encounter in their autonomous operation.

Furthermore, capital is also essential. The businesses are heavy on development costs, especially software costs. The end markets are also highly competitive, imposing tough price constraints. The hardware itself is likely to be commoditized and many will outsource manufacturing once they have settled on a suitable final design. The payback for many will be having a large fleet to offer robots as a delivery service.

Future outlook: significant robot sale and delivery services opportunity

However, even such firms are likely to have a long road ahead of them before they reach profitability. They should improve the robots to work in more scenarios beyond well-structured neighborhoods and campuses, to extend their operation to all-day and all-weather conditions, and to extend autonomous operation with little error to nearly all scenarios to drive down the remote operator-to-fleet size ratio. The deployed fleet size will need to dramatically increase to expand income from delivery services and allow the amortization of the software development costs over many units sold.

We have analyzed all the key companies and technologies in this emerging field. We have also constructed a forecast model, considering how the productivity of last mile mobile robots is likely to evolve over the years. We have developed various scenarios, assessing the current and future addressable market size in terms of total accumulated fleet size. Our fleet deployment forecasts and penetration rate forecasts are based upon on reasonable market and technology assessments and roadmaps.

In general, we forecast a 200k unit fleet size until 2035 (accounting for replacement). The inflection point will not occur until around the 2025 period given the readiness level of the technology. This suggests both a large robot sales market and an even larger annual delivery services market provided asset utilization can be high (the services income could reach $1.6Bn by 2035 in a reasonable scenario).

Consequently, our forecasts suggest, that despite the upfront technology and market challenges, the market will grow and those who plant their seeds today will reap the benefits tomorrow. To learn more about the companies active in this field, the technology challenges, approaches, and roadmap, and detailed 20-year market forecasts please visit www.IDTechEx.com/Mobile.

This report covers the use of mobile robots, drones, and autonomous vehicles in delivery, warehousing, and logistics. It provides a comprehensive analysis of all the key players, technologies, and markets. It covers automated as well as autonomous carts and robots, automated goods-to-person robots, autonomous and collaborative robots, delivery robots, mobile picking robots, autonomous material handling vehicles such as tuggers and forklifts, autonomous trucks, vans, and last mile delivery robots and drones. It provides technology analysis, market analysis and forecasts, and player overviews.

To find out more about Robotics research available from IDTechEx visit www.IDTechEx.com/Research/Robotics or to connect with others on this topic, IDTechEx Events is hosting: Material Opportunities for Electric Vehicles, 13 - 14 May 2020, Estrel Convention Center, Berlin, Germany www.ElectricVehiclesEurope.Tech.

IDTechEx guides your strategic business decisions through its Research, Consultancy and Event products, helping you profit from emerging technologies. For more information on IDTechEx Research and Consultancy contact research@IDTechEx.com or visit www.IDTechEx.com.

Featured Product