Year-to-Date Numbers Show Decline in Robotics (18%), Machine Vision (8%), and Motion Control (6%) Orders Compared to 2019

Last week, the Association for Advancing Automation (A3) and ITR Economics delivered a Global Economic and Automation Outlook, providing year-to-date updates and forecasts through 2021 based on recent market data reflecting the impact of COVID-19. A3 statistics showed robotics, machine vision, and motion control markets all contracted in the first half of 2020, compared to the same period in 2019. The recorded economic outlook webinar is available for viewing until Wednesday, September 2, 2020.

Market Statistics

Robotics

“It’s clear that our industry is feeling the effects of COVID-19, its strain on supply chains, and the overall economic uncertainty due to our current circumstances,” said Alex Shikany, A3 Vice President, Membership & Business Intelligence. “Despite the numbers reflecting these recent challenges, our latest market surveys tell us that there is optimism for what the next six months will bring.”

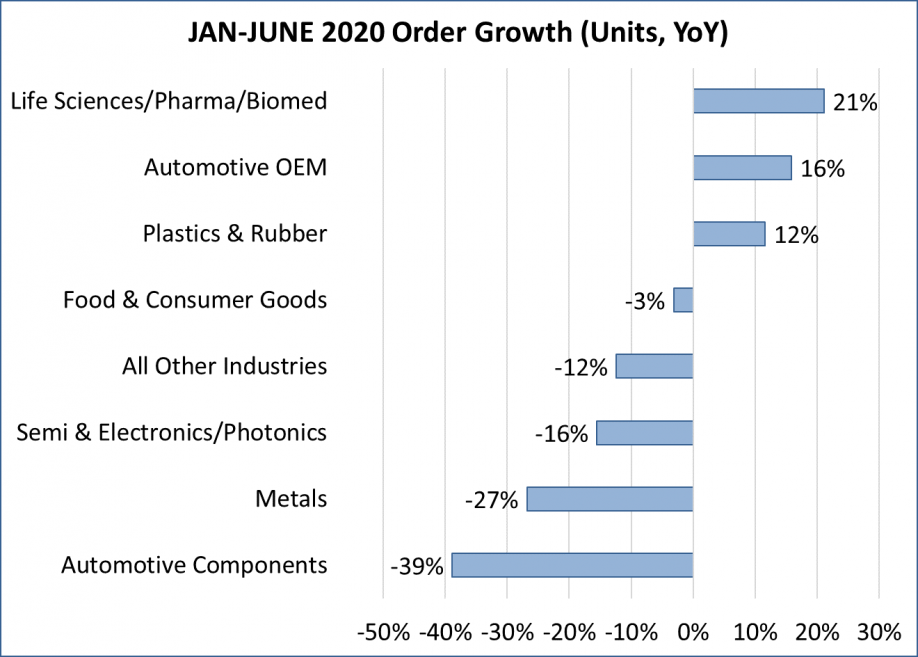

With 13,524 units ordered, the North American robotics market decreased 18% from the first half of 2019. Order revenue totaled $716 million, which is also down 18% compared to the first half of 2019.

“Despite the overall contractions, there were two notable industry bright spots in life sciences (+97%) and plastics & rubber (+49%),” Shikany said.

A3’s recent survey of its robotics industry members showed optimism about what’s to come. When respondents were asked what they believe will happen to their sales in the next six months, 36% believe they will increase moderately (between 1% and 10%), while 22% believe they will increase significantly (more than 10%). Only 19% of respondents believe there will be further decreases, while 23% believe their sales will remain flat.

More details can be found in the economic outlook webinar.

Machine Vision

The North American machine vision market is also below one year ago levels, decreasing 8% in total to $1.3 billion.

Machine vision components, consisting of cameras, lighting, optics, imaging boards, and software, fell 9% in total to $174 million. Machine vision systems, including application specific machine vision (ASMV) and smart cameras, fell 8% to $1.1 billion. For a summary of these figures, and more details in each category, register to watch the webinar recording.

When asked about the next six months, A3 vision and imaging members were similarly optimistic, with 42% believing sales will increase moderately (between 1% and 10%), and 17% believing sales will increase significantly (more than 10%). A greater share of vision respondents (27%) believe there will be further decreases, while 15% expect sales to remain flat.

Motion Control

Order revenue in motion control and motor markets totaled $1.669 billion in the first half of 2020, marking a 6% decrease from last year.

All product categories (including motion controllers, AC drives, motors, AC motors, actuators, sensors, and support) experienced year-over-year decreases in revenue. Electronic drives was the only category which increased, growing 1% to $251 million. A full order growth rate overview is explained in the economic outlook webinar.

Survey data from A3 motion control and motor members revealed 49% expect moderate increases in the next six months, but only 6% expect significant growth. Motion control and motor respondents showed slightly less optimism on what the next two quarters will bring, with 32% expecting further declines. Only 13% believe the market will remain flat.

Economic Outlook

Alan Beaulieu, President of ITR Economics and leading economic forecaster, discussed the future health of global manufacturing and highlighted growing industries, including logistics, warehousing, automotive, and electronics. He also presented economic and manufacturing updates on various key regions important to automation, including North America, EU, China, and Mexico.

Beaulieu reported an encouraging seasonal rise this June-July in total US retail sales, noting the increase is the second best on record. Additionally, he discussed the beneficial surge in US disposable personal income, which he noted doesn’t happen in a recession.

The US stock prices index is showing a return climb to pre-pandemic levels, and the Housing Market Recovery Index is likewise showing positive input.

According to research, there will be an increased foreign demand in 2021 for US Exports in the robotics trade. Here all of Beaulieu’s forecasts in the recorded webinar.

About Association for Advancing Automation (A3)

The Association for Advancing Automation is the global advocate for the benefits of automating. A3 promotes automation technologies and ideas that transform the way business is done. A3 is the umbrella group for Robotic Industries Association (RIA), AIA - Advancing Vision + Imaging, Motion Control & Motor Association (MCMA) and A3 Mexico. RIA, AIA, MCMA and A3 Mexico combined represent over 1,260 automation manufacturers, component suppliers, system integrators, end users, research groups and consulting firms from throughout the world that drive automation forward. For more information, visit: A3, RIA, AIA, MCMA, A3 Mexico.

The association hosts a number of industry-leading events, including Robotics Week (September 8-11, 2020 virtual), International Robot Safety Conference (October 6-8, 2020 virtual), Autonomous Mobile Robot Conference (October 26-27, 2020 virtual), AI & Smart Automation Conference (October 28 -29, 2020 virtual), and MCMA Tech Con (November 9-10, 2020 virtual). Other events include the A3 Business Forum (February 1-3, 2021, in Orlando, FL), and the biennial Automate Show & Conference (May 17-20, 2021 in Detroit, MI).

Featured Product